m2C Conference Prague: How China's online giants are changing retail

|

| "New Retail" connects online and offline, for the benefit of the customer and the company. / source: Agency China |

Prague (March 15, 2019). In 2016, the Chinese online merchant Alibaba redefined retail: It went offline. Because acquisition costs for the customer are lower in store. Apart from that: The Chinese still tend to buy offline, defying their general addiction to the internet. The result of Alibaba's decision: Since then, it's no longer been the retail groups, but the internet and technology giants that have worked hard on efficiently combining online and offline sales and so to learn even more about the individual customers. "New Retail" is the magic word of the future.

Behind "New Retail" is the new understanding of "Retail as a service – powered by data collection and data sharing," Michael Norris reported, Strategy Manager of AgencyChina at the m2C marketing to China conference in Prague at the end of January. hospitalityInside.com is media partner to this event and has discovered many parallels there with the hotel business. In the app economy China, highly specialised applications make it possible to analyse customer behaviour in greater detail than ever before. In addition, cross promotion and specialised platforms are also a huge help in analysing and directing customer behaviour.

Since 2016, offline shopping has stagnated in China. It stayed put at a market share of roughly 76%. This also means that online sales stagnated at around 24%. This gave Alibaba founder Jack Ma cause to think. He redefined retail as "New Retail" – a term which is today already commonplace in China and it means: "A consumer-centric, data-driven form of retail, the core value of which is to improve the retail industry's operating efficiency."

With this, he means that internet and tech giants are the new retail pioneers and that there will be larger e-commerce penetration in view of the slowdown in e-commerce growth. The main target is to generate higher revenues with lower costs. To this end, closer data analysis is used: New Retail uses data, digitisation and technology because, together, they will change both the supply and the value chain.

Top synergies: Try online, buy offline

|

|

| China's Vlogger Ashley Gallina is herself a KOL, signing here her latest book in Prague. / photo: map |

Alibaba and Tencent embody the biggest online retailers; both compete with each other fiercely into the smallest of niches, as demonstrated last week (see link below). And their ambitions draw more and more technology into the battle for the customer. Why? Every square metre of floorspace costs money, which is why retail professionals meanwhile still work in terms of sales per square metre.

Traffic heat maps in a shoe store show how customers move and, above all, where they come to a stand. Armed with this information, the seller is better equipped to appeal to customers in these "hot zones" and can offer more service. The heat map is also used to determine how expensive and cheaper products are to be distributed on shelves. RFID chips in shoes and carpets respectively pathways provide data on the conversion rate as do 3D scans of feet.

"The revolution in retail is taking place in the fashion, fresh food, beauty and furniture segment as well as in electronics," Michael Norris says, explaining the approach taken by the Chinese manufacturer: They test their products online first and then move on to the offline market in the case of positive customer feedback (measured in terms of orders). And: Only then does the product receive its branding. In addition, the online test also makes it possible to control consumer demand practically "on demand". That too reduces costs – in production as well as regarding shop floorspace. "In this way, the product becomes the service, on a subscription basis as it were," Norris explains of the new e-commerce thinking of the Chinese online retailer.

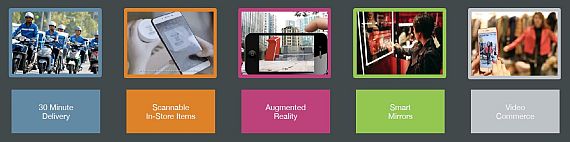

Online to offline (or vice versa) therefore becomes the catalyst, which means that online and offline merge. In the expert vernacular, this development is described as O2O (online to offline) and OMO (online merger offline). Online portals and online apps make it possible to scan a QR code to order food, reserve a restaurant table or cinema tickets or take part in bike sharing. The "New Retailers" add to that the necessary experience, of course in a virtual manner. Information on the product is provided by augmented reality in a playful way and there is reward for those who try things out...

Retail expert Michael Norris is quite certain that China and the US will drive global retail innovation in future, with China moving forward fastest because in this part of the world cashless payments are already the norm.

Breaking sector barriers

Shopping and purchasing are thus beginning to decouple as processes – and therefore offer new opportunities in e-commerce. Just how important that is was underlined by Ashley Galina with a statistic from a Chinese retailer: Distribution costs account for 60-70% of the sale price. As social media expert, book author and vlogger (video blogger), Galina is one of the leading key opinion leaders with millions of fashion and beauty-crazed followers hanging on her every word. Data experts know exactly what age groups in what cities buy what and how much they pay for it – online as well as offlice of course.

|

|

| The influence of the KOL - Key Opinion Leader - is valuable, but has to be paid dearly. / source: Galina |

With this information in hand, retailer can approach customers more cleverly, above all in the luxury segment where it is possible to play best on the emotional level. Cross promotions are currently very popular in China. Here, the tea brand Heytea formed an alliance with the skincare brand Pechoin. The products are also offered offline, but only in pop-up stores. And anyone who manages to catch a "real" cup of Heytea in the hot promotion period is immediately posted as "winner" online. A success which the customer can immediately celebrate in social media... Their friends will of course see it too. The emotion game has in the end been given a promotion code.

Emotion and the desire for a special product can be spun very well: by artificially restricting the product and with additional personalisation. For example: Handbag manufacturer Loewe had one of its usual stylish handbags produced in a garish pink and sold this on Valentine's day with the label "China exclusive" at a horrendous price. It was a huge success as young Chinese consumers very much believe that limited and exclusive editions improve their status and give them easier access to their dream world. Products get even greater e-commerce traction when the manufacturer label can be replaced by the buyer's photo. This sounds like a non-stop ringing from the cashier's till.

Special platforms with new temptations

With a great sense of Humor, Ashley Galina, originally from Belarus but who has lived and worked in China for the last twelve years, says this to Europeans shaking their heads in the conference room: "Imagine the Chinese consumer like your worst friend". The Internet makes consumers demanding, addicted to more and to ever new superlatives. "Everyone who buys a product in China goes on social media or submerges themselves in e-commerce tools." The latter includes an increasing number of specialised web platforms. Weibo Window, for example, links directly to the desired product photos, RED excites 20 to 35-year-old travel, food and cosmetics junkies, Pingduoduo (similar to the European Groupon system) sells anything from serviettes to fruit with up to a 90% discount – if the consumer can motivate ten others to purchase the product too. The deal principle is simple: The more people buy, the bigger the discount. New Retail makes this possible. / Maria Pütz-Willems

Continuative Links:

To print this article you have to be registered and logged in for newsletter, visitor or subscription.