12th ITB Hospitality Day talk about the role of metasearchers and hoteliers

|

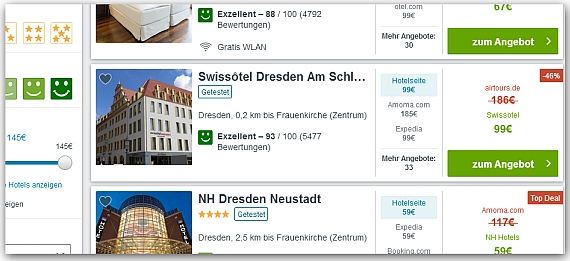

| Metasearchers (like Trivago) compete with OTAs today. Customers benefit from it. |

Berlin (April 21, 2017). Hoteliers continue their fight against OTAs, but OTAs have their own problems now: they have to stand their ground against metasearch engines. In addition, mergers have also become part of the agenda in this segment. The middle class seemed to be drifting off further, admitted private hotelier Marius Donhauser. Therefore, Trivago's Managing Director Johannes Thomas is focusing on search results for individual as well as chain hotels more than ever. Because of these dynamics in the market, HRS' CEO Tobias Ragge sees great chances for local players, as he stated at the 12th "ITB Hospitality Day" in Berlin in March. But all in all, the entire distribution has developed into a "money game".

Tobias Ragge, CEO of the HRS Group, is still quite relaxed about the increasing concentration in the chain hotel industry; instead, he is looking for ways to optimise his own business: "The chain hotel industry has a share of 24 percent in total," he said. "And they are all merging among themselves as they need a scale for the investments in technology." However, when breaking down the global market share of the industry giant Marriott after the Starwood deal, it is only at three percent; in cities like New York or San Francisco it is 10 percent. And: 15 percent of the total turnover of a chain hotel has to be forwarded to the chain's headquarters. "A local player has some advantages here, as long as he is flexible and has an intelligent marketing strategy," said Ragge. The global players, however, are endangered of becoming arrogant and subsequently scaring away guests.

A hotelier, who focuses on his core competences and looks for good distribution partners, still has prospects of success compared to the chain hotel industry, said Ragge. However, this is different in the corporate business; the market has already been occupied by the chain hotel industry by 63 percent. Ragge: "We want to create the best experience for business travellers by 2020." Besides the purchasing of rates, this also includes the billing as well as special programmes for businesses. Whether metasearcher, multi-sourcer or OTA: they are all still cooperating with the brand hotel industry, which, in the meantime, always emphasises that it does not want to – or cannot – do without external marketing entirely.

|

|

| Tobias Ragge, HRS: Distribution becomes a "Money Game". |

At the ITB Hotel Conference, a vivid panel tried to reveal the proper marketing strategy for the industry. Carolin Brauer, Managing Director Quality Reservations, was the host and presented Trivago's Managing Director Johannes Thomas, HRS' CEO Tobias Ragge and Marius Donhauser, owner of the hotel Salzburger Hof in Salzburg, an online-affine representative of the private hotel industry. Apart from his job as hotelier, he also founded the digital hotel organisation tool called "hotelkit".

The clock cannot be turned back

Very quickly, it became obvious here: the cooperation of the hotel industry with third-party marketers such as OTAs cannot be turned back again. The question, whether the hotel industry will be able to partially win back the booking of the online guests, was asked right at the beginning and the audience answered it more positively in this first round than at the end of the discussion. At the beginning, 54.5 percent voted with "Yes" and 45.4 percent with "No"; later, however, it was 42.1 percent "Yes" and 57.9 percent "No".

Johannes Thomas is convinced by the future of the metasearch engine Trivago: "We organise the market and provide better access," he explained. This way, the customer saves time and money. The user no longer has to visit five to ten platforms. When providing the results, Trivago pays attention to rate, content as well as reviews. "We do not collect reviews but we view them and show the user via semantics analyses what he can expect regarding quality and performance."

The manager does not fear a consolidation in the metasearcher market at the moment. "The asset of a metasearcher is technology," he explains confidently. "Within seconds, we collect rates from websites and invest in our brand. Very early on, we decided not to become dependent on Google. More than half of the users come directly to Trivago." They are loyal customers who understood the concept of metasearch and wanted to use it. Trivago's business philosophy has been explained thoroughly to the customers, amongst others by the global Mr. Trivago spot. "We have the site for transactions but we are not a booking platform. We do not want to hear the customer say: 'I booked with Trivago.' As soon as the customer calls us and wants to change a booking, we did something wrong," said Thomas.

|

|

| Johannes Thomas, Trivago: The customer can expect a strong search engine. |

They operate 100 percent independently from the parent company Expedia. The biggest target is to turn "lookers" into "bookers". In future, the company wants to concentrate on the development of even more strength concerning the search. "If a customer uses our system, he has to find a hotel," said Thomas. Asked about new players in the market such as Check24 or Verifox, Thomas said: "Our largest market is the US, then comes the United Kingdom; these portals are from the region of Germany, Austria and Switzerland (DACH) and will never be as good as a company, which, with its 1,100 staff members in 55 markets, exclusively deals with hotels." Trivago also develops systems, which are able to cope with free search keywords as well as voice.

Multi-source contra metasearch

In contrast to Trivago's metasearch, HRS also provides offers of other providers on its homepage through a so-called multi-source. "We integrate other provides via APS (interfaces)," explained Ragge. If somebody offers the hotel more cheaply there than HRS, it can be booked through HRS. HRS takes over the fulfilment and customer handling. "The customer does not realise that he is booking somewhere else," said Ragge. In this case, the other providers have to pay a commission to HRS. "We simply show who has capacities and the cheapest rate. We also receive commissions for every booking from others providers." However, HRS only receives the money in case of success, which means for a booking.

Therefore, it is not really surprising that the hotelier is losing influence and is no longer able to keep track of things in this roundabout of rates. "He has different tasks," said Donhauser, commenting on the matter. "He is able to decide on his products. Reviews and products have to be good. Then, I leave the topic of rates."

In the end, direct distribution also costs the hotel a lot of money, according to Ragge. Most important is, however, who of the providers is best able to depict the arbitrage effect. He knows how much work there is to do in a hotel, said the CEO of HRS. Therefore, it is nearly impossible to personally optimise the digital marketing in addition. This kind of work has been underestimated regularly. "With the rate, the hotel market has a structure, which leads to over-capacities," said Ragge. Marketing only works as a mixture. Only very few hotels handle everything by themselves. "It is a money game about who has control over the access," said Ragge further. It is decisive how brands and properties can be found, whether it is via Google, Trivago, TripAdvisor, OTAs, or apps. Also Alexa, Amazon's digital voice assistant, plays an important role in the future.

|

|

| Marius Donhauser: Hoteliers should be able to concentrate on different jobs. / photos: HI |

Niches for the private hotel industry

It is still difficult to market one's own hotel as a private hotelier, explained Johannes Thomas. An increasing number of tools are available in the market, which facilitate direct marketing. But technology and marketing have to be coordinated. "The question is, how do I position myself online? It is important to have story telling across all channels," explained the Trivago manager.

At the same time, all portals have to be observed, which appear on Trivago. "Who is Elvoline, 7ideas or Rooms XXL? Where do they come from?" Trivago has a relations team that approaches all portals. Then the technical connection is checked and in the end, an auction model decides in which position the hotel will be listed. The decisive point is the hotel room rate. As Trivago earns money for the click on the forwarded site, it is decisive, who achieves the highest CPC (Cost Per Click. "If a hotel has a higher click rate, then we are able to include this in the personalisation."

In light of the numerous mergers in the chain market, Ragge and Thomas see reasonable chances of survival for the middle class: "The local players have advantages, as long as they are flexible and follow an intelligent marketing strategy as the global players could become too arrogant now," stated Ragge. "If a hotelier concentrates on his core competencies and looks for a distribution partner, he can be successful."

The medium-sized entrepreneur, Marius Donhauser, is observing the mergers in the online booking market rather anxiously. "I hope that Google will be successful with Hotelfinder as well as Amazon; this way, the market will not be dominated by one or two players," he said. / Susanne Stauss

In a separate ITB press conference, HRS' CEO Tobias Ragge talks about other aspects of the OTA market and the role of HRS (see magazine).

Watch the video of this panel in full length!

Continuative Links:

- April 7, 2017 Difficult turn rapid boom ITB Hospitality Day Talk on Iran Greece Georgia and Russia

- March 17, 2017 Tasty colorful social central ITB Hospitality Day Talk 2017 Hostel experts about the new colorful feeling

- March 24, 2017 Guests going crazy ITB Hospitality Day Talk about the new impact of Internet of Things and AI

- March 31, 2017 Stay safe, always care ITB Hospitality Day Talk about hoteliers role concerning safety security

To print this article you have to be registered and logged in for newsletter, visitor or subscription.