ITB Hospitality Day makes Google and Booking.com clarify their strategies

|

|

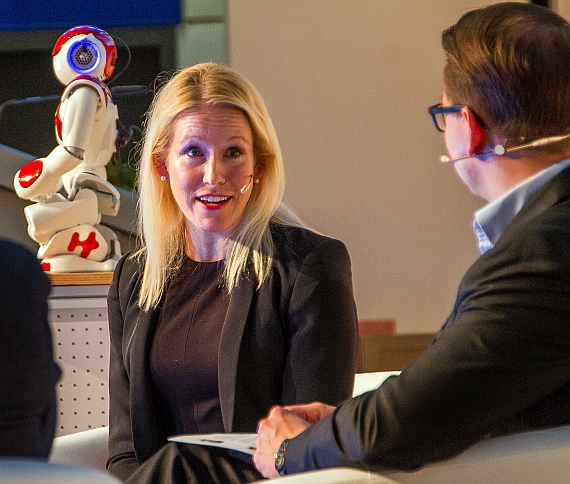

| Relaxed talk with the audience: Terri Scriven of Google, moderator Wilhelm Weber and Peter Verhoeven of Booking.com (from left). |

Berlin (April 1, 2016). Fighting hard to regain control over their distribution and most importantly over their customer data, even major players in the hospitality industry have lost ground over the years to OTAs and metasearch engines. Yes, hotels are resisting, but isn't it a lost battle? During last ITB' Hospitality Day, one session moderated by Wilhelm Konrad Weber, partner at Swiss Hospitality Solutions touched on many topics and what’s more, with two very talkative guests: Terri Scriven, Industry Head of Hospitality at Google UK and Peter Verhoeven, Managing Director EMEA at Booking.com.

Both explained how dynamic and exciting the travel world was becoming, noting that many new disruptive players are entering the game (e.g. Airbnb). Consolidation, acquisition, innovation, disruption, etc. The distribution landscape is evolving and with it, mentalities and consumer expectations. So, who is fitted to win over the client?

Being guest centric, whenever one develops or sells a product is essential. That's basic marketing and Google is well aware of that. Only a couple of weeks ago, it launched its last innovative tool, "Destinations on Google" which is 100% designed to ease travelers' lives when searching for their next trip. People check their phones 150 times a day on average according to Google. "We recognized the rapid evolution of consumer behavior, how they use mobile devices during micro moments and how important it is for us to provide them with fast and simple answers," explained Terri Scriven, adding that Google came up with this new service utilizing a lot of data on Android.

"Destinations on Google" is activated once one types in a country or a city and then adds the word "destination" or "vacation" on his mobile device (e.g. spain + destination). Results can be filtered by interest for a more personal search experience (golf, nature, family, etc.). From what to do, when the best time is to go, to weather forecasts, hotels and flight prices (Google displays the high and low rates for the next 6 months), one can find it all on one page. Available on mobile only, this new feature ensures a more tailored yet simple search experience.

|

|

| Peter Verhoeven: OTAs should offer more services at the guest's destination, provided alreading during the booking process. |

This "holistic approach" seems to have captured Booking.com's interest as well. As Peter Verhoeven mentioned in Berlin, Booking.com is all about precision and conversion but not only. The platform transacts about 1 million room nights per 24 hours. "Thousands of tests are done every day as we need to take more incremental steps. It's crucial as it's our core business. We still believe that it is time for us to add more things to the customer's experience, during and even before his journey starts, something we are not doing now. Proposing ticket sales for concerts or museums, helping the customer at the destination... we can enrich that part of the process, adding more emotions to the transactional experience. We are currently testing the service at a museum in Amsterdam. It is worth investing more in this."

OTAs stay connected to guests

more than hotels

Probably hoteliers won't be pleased with this. Many of them use these moments to interact with their guests once they have checked in. It's a way to capture their attention and eventually sell them additional services (restaurant, happy hour at the bar, renting a hotel bike, using the spa or the concierge service…).

Yesterday, Booking.com (and other OTAs) was out of the equation after the customer reached his destination. Tomorrow, they will intervene via mobile and encourage guests (who booked through them in the first place) to actually go out, visit the city, try the trendiest bars and restaurants in town, check out an exhibition, etc. - in a nutshell, stay connected to them. If OTAs see this kind of innovation as necessary to enhance the customer experience and keep on interacting with the customer even after he has booked, no doubt hotels will see it as another way to undermine their efforts to reconnect with their own guests. But it's up to hoteliers to do the same. Accor for instance, through its platform accorhotels.com, is currently developing such services for mobiles in order to maintain communication between staff and guests using Wipolo, a startup it acquired last year.

"At Priceline, 300 people are working on mobile"

Communicating is crucial and it is all happening mobile. As Peter Verhoeven summed it up: "Today, it's not about having a mobile strategy anymore. You are mobile or you are not!" At Booking.com, one out of three bookings is done via mobile and 50% of it concern last minute reservations. This number is skyrocketing. CEO of Priceline Group, Darren Houston, who was a speaker during another conference at ITB, mentioned that 4 teams are exclusively developing products for Android, same with iOS etc. "In 2011, 3 people were working on mobile, now there are 300. Customer behavior is changing drastically and we have a lot more work to do on that," he said.

|

|

| Distribution topics always attracted masses of people. This year, the ITB Hospitality Day Berlin counted more than 1,700 visitors - plus more than 700 watching the conference in the livestream. |

Google as well, is all about mobile. To steal one of the three advertising spots available on tiny phone screens, Terri Scriven is advising hoteliers "to be smart, target high value users and loyal customers, use marketing tools for search, etc. "There is a lot to do to capitalize on that and take those three spots," she explained. Easier said than done one would say, especially for small structures which are not equipped to fight in this hyper-connected world.

Small or big, hoteliers are trying everything they can to regain control over their distribution and their customer data, and consolidation is one way of achieving it. The takeover of Marriott/Starwood Hotels will give birth to the largest hotel group in the world and the combined loyalty programs of both chains could potentially liberate them from OTAs' pressurizing terms and conditions. Acquiring Fairmont/Raffles/Swissôtel will give AccorHotels more visibility worldwide and, most importantly, access to the luxury segment they tried so hard to enter with Sofitel. Regarding OTAs, the group is betting on its distribution platform developed with Fastbooking (acquired last year). Already 850 independent hotels have joined AccorHotels' own brands, the group said at ITB. The group targets 7,000 partners on top of its own hotels.

When asked whether accorhotels.com was now competition to Booking.com, Peter Verhoeven, (an ex-Accor top manager himself) was pretty nice to its former employer comparing it to a type of baby OTA. "It's innovative for a hotelier. Do they have the same scale as us? No. It's different, but it's a way to get more scale. From a consumer point of view, having more choice is always good and we try to complement that with a ROI that hopefully makes sense."

"Telling consumers how they should use the Internet is weird"

Booking direct is on everybody's lips at the moment. Hyatt, Marriott, Hilton, AccorHotels… million dollar TV campaigns are currently on air. The message to the consumers is that the best price, the best offer, the best deal will always be found on their websites. What is it with hoteliers who partner with OTAs but at the same time give everything not to do business with them?

|

|

| Terri Scriven: Google does not plan to market Airbnb accomodations. |

Terri Scriven has an interesting explanation for this phenomenon. For her, it's all about data. "Direct booking campaigning is a lot about the ownership of customer data. It's important that hoteliers have a balanced view over all channels driving their revenues. And owning the customer data is incredibly important, because with them, they can provide better quality of service for the hotel but also suggest offers or simply better target their audience with key marketing messaging. Through OTAs you can't own that data, booking direct is all about hoteliers trying to harness and get access to that data."

Something is indeed blurry in this partnership, since for Booking.com, it's all about the value you bring to your partners. "Everybody is trying to drive direct business and it's all good. At the same time we try to be partners. We (Booking.com) spend a lot of money with Google and hotels spend it with us. Everybody has to look at their ROI and investment. It's complex, it's a lot of work, and one has to be good at it. But hotels need to choose what they want to do: hospitality or distribution, these are two different jobs?"

Verhoeven's boss Darren Houston, was less diplomatic on that matter on the other stage. "I find it strange that hotel chains are telling the customers how they should use the Internet. It's weird and annoying as we are partners and bring business to them. We spend 2.8 billion dollars in marketing to define demand. Hotels want direct bookings but most of them are not even ready technologically speaking. We can build a website in a minute," he said.

While looking sympathetic, Darren Houston seemed a bit arrogant on that stage. In what could appear as an attempt to crush hotels' expectations regarding direct bookings, he reminded the audience that "only 2% of guests stay in the same hotel twice." In other words, hotels are wasting their time, energy and money trying to build up loyalty on people they probably won't see again.

And as if it was not enough, he joked about booking direct campaigns "making a lot of noise", while in reality people still like to work with his group. "Smart people know we can convert," he hammered. That's why even in countries where rate parity is no longer part of the contract, many entrepreneurs still choose to give Booking.com parity, "because they know we deliver. Since we are doing all efforts on web marketing, we think it's normal to get the same rate as we are only paid on transactions," added Peter Verhoeven. His boss wrapped it up saying: "We have to work together to make the customer end experience great."

For some reason, many people, including the audience attending the session at the ITB Hospitality Day, didn't buy this message. And it was proven by the final TED question at the hotel conference: "Should hoteliers leave distribution completely in the hands of OTAS or other distribution specialists?" 82% answered "No", bookings should not entirely rely on OTAs, 13% said "yes" and 4% "maybe".

|

|

| Memory photo with Mario: The three IT professionals also enjoyed the first meeting with the hotel robot. |

Commenting on the instant results, Peter Verhoeven explained that there is a strategy for every property. "No one size fits all here." More sceptic, Terri Scriven followed the majority, although officially, Google has no interest in picking a side. Just like the "Switzerland of Internet", they remain neutral, helping both hoteliers and OTAs to drive more traffic to their own websites.

Google and TripAdvisor

not OTAs?

One could wonder though, if slowly but surely, Google is not becoming an OTA itself. "Destination on Google" is allowing guests to find the perfect travel package, and "Book with Google" to make a reservation (and even pay on specific markets) without leaving Google's page. So what is Google?, the moderator asked Terri Scriven who made it very clear (from her point of view): "We are not an OTA. Our partners are the merchants of data, not us! It's a key distinction in terms of being an OTA. They own the customer data."

Just like Google, TripAdvisor which developed "instant booking" also claims it is not an online travel agency. "We are not merchants. We don't provide customer service. Whoever takes the booking is," said Adrian Hands, Senior Director CPC Sales EMEA, who defines TripAdvisor as "a media company, which provides content. And content is as important as traffic," he said.

With 350 million unique users per month and 200 reviews posted per minute, TripAdvisor has the potential to attract millions of travelers and hoteliers can't ignore that channel. Many of them have joined the "Instant Booking" service already. "Major hotel groups have signed up and pretty well all groups will in the future," predicts the Sales Director whose group also signed an exclusive partnership (for now) with Priceline, Booking.com's parent company. "We want to have Expedia as well in the future. We have to be democratic or it won't work," explained Adrian Hands.

Airbnb brand awareness surpasses Marriott's

Unlike Google, TripAdvisor is also involved in home rentals via two listing platforms for guests and hosts to interact, TripAdvisor and FlipKey, its own rental vacation site. According to the website over 100,000 owners have already enrolled. If TripAdvisor has the profile to catch up on Airbnb, Booking.com has chosen another path. While Peter Verhoeven finds Airbnb's model "admirable", he concedes that they are crashing barriers that Booking.com probably wouldn't do. "We list many apartments and homes on our website and make it as easy to book as hotels but we are more into a license operator model." For him, Airbnb is showing a new way of doing tourism in a city. It facilitates access to travel to a greater number and "that's beneficial to all of us at the end".

No doubt that there are a lot of innovative concepts out there that drive the industry into rethinking their approach. However, while attracted to the concept, Google has no intention to offer Airbnb's inventory on "Book with Google". "Search for Airbnb on Google has increased by 105% last year. Its brand awareness has surpassed some of the strongest hotel chains such as Marriott or Starwood. That being said, Google has no plan in the near future with the rental platform," confirmed Terri Scriven, although she likes using Airbnb when traveling with her family and Booking.com "when on the go for business."

When asked who she thinks is a potential game changer in the industry, she didn't think long before betting on companies like Roomer (roomertravel.com) which manages hotel cancelations, Snapshot and of course TripAdvisor's "instant booking" tool. Unlike Terri, Peter didn't mention company names but concept ideas. "Any innovative model which will make travel less commoditized is a potential game changer," he concluded. / Sarah Douag

Watch the video of this ITB Hospitality Day session 2016 here in full length!

Continuative Links:

To print this article you have to be registered and logged in for newsletter, visitor or subscription.