20th IHIF Berlin: Deal makers are happy, operators do not gain any foothold

|

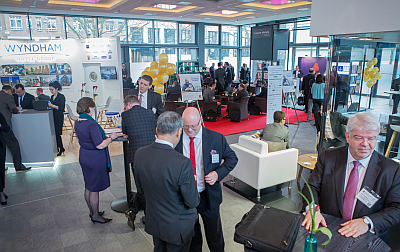

| The International Hotel Investment Forum as the industry meeting place: Most questions were discussed behind the scenes. |

Berlin (March 17, 2017). Somehow, it was just like last year. Only when the subject was broached again did some of the IHIF participants furrow their brows with worry: at the end of this European election year, they will know more, whether 2018 will cause a crash in the (hotel) property and investment segment or not... Until then, brokers, bankers, investors, and operators were and are running breathlessly in circles, keeping the huge money wheel in motion. The hotel asset class is booming, operators are earning good money, but the industry has not found its way into the future yet.

Among many international investment and real estate experts, the International Hotel Investment Forum (IHIF) is still a pulse meter and network magnet. However, there is no big news. In the panels, the CEOs did nothing to raise the excitement. Whitbread's head Alison Brittain invests 700 million in properties every year, continues to serve Costa Coffee and sells Premier Inn beds, especially in countries similar to the UK (Germany, Russia). CEO Richard Solemons of IHG continues to defend (his) brands and started the 100th appeal to use IT for the customer journey and research for the actual needs of the guests. Change has finally come: after asset light and technology, the focus is on the guests' needs now. "This is the evolution," he said.

When hearing such general statements, presented by nearly every CEO every year, I always ask myself: What has the industry done up to now? Not researched the guests; not taken them seriously; not used IT? Not made the beds; not served breakfast; not offered concierge services? Something has to have gone terribly wrong at some point.

|

|

| Business Talk and networking in the winter garden of the convention centre at the InterContinental Hotel Berlin. |

AccorHotels' CEO Sébastien Bazin does not only talk but also acts. He buys and buys and buys... and changes the business visibly. Whether it will go well in the end, the investment expert with his CEO side job still has to prove it. But the industry regards him as a visionary, who thinks outside the box: after all, he just discovered the neighbourhood around the hotels and wants the shoemaker, the tailor or dressmaker and the dry cleaner's next door to become concierge pals. At least his talk was inspired by ideas, because he included all people, not only his own staff members. He also mentioned OTAs and the names of competitors, contrary to the always smart Marriott CEO Arne Sorenson.

The industry polarises

Large chains, which are getting larger through mergers and acquisitions, are frequently getting slapped in the face verbally, but only behind closed doors and not out in the open: the industry is polarising at the moment – the gap between mega and mini is growing. For most of them, power games, which are based on volume, are no longer a guarantee for survival. Anbang showed how easily you can cause big Marriott to stagger.

The counter trend is quality and niche, especially in the fragmented and brand-weak Europe. International chains are flooding this market with new brands on a regular basis. And also with new "labs" lately – workshops for experiments. Because these curious customers are booking online – not chain hotels, but rather an unknown, nice accommodation at a good location for a good price. And because Millennials are making everything worse with their smartphone addiction. And Airbnb is lending a big helping hand here too. This year, however, we only hear very little about this hospitality ghost.

|

|

| Sought-after interview partner: Marriott CEO Arne Sorenson. / photos: IHIF, Mark Green |

Between the doors of the IHIF, the future of the large chains as well as their influence had been discussed frequently. And contrary to the nice pretence provided by the new power players, the following (basic) questions arose: Chains are only brand administrators, right? Are 30, 15 or 8 brands an asset? What's their value? And how do the strongly expanding franchise chains control the quality of their franchisees? Chains are not able to mutate to OTAs – or should not, at least: most people have great respect for Booking.com, its performance and its marketing billions.

More actionism instead of help

For me, the 20th IHIF shows the following in 2017: There are so many things, which were not discussed in public, free of any personality cult, image thinking and sponsoring framework. The discussions have gone round in circles for years, have become more frantic on the stage and therefore scarcer as a result. Actionism, not vision, is driving consolidation. The term "scalability" was used much more often than "staff member". Volatile markets after the terror and scenarios of fear prior to / after the elections around the globe are easier to describe than one's own weaknesses. Specific solution approaches were missing everywhere.

The hospitality deal makers are well off. These times are good. As soon as the deal is done, everyone just waits for their commissions. And then it goes on. This seems to be a parallel world next to the one of the hospitality operators. They are unhappy about themselves, they did not gain any foothold on the new paths, they are still stumbling along the crash barriers, which were defined by others (OTAs, Airbnb, regulators). Considering the high dynamics and the geo-political conditions, this is not surprising. All the more could such a magnet as the IHIF give the industry structure and specific help here. But this is not easy as the mega event is about to change too. / map

Continuative Links:

To print this article you have to be registered and logged in for newsletter, visitor or subscription.