INVESTMENT Barometer Autumn 2017 asked about locations and crisis scenarios – Public version

|

Augsburg/Hamburg (November 24, 2017). Despite demand pressure on the German hotel market, C locations will not become the new B locations. The current INVESTMENT BAROMETER Autumn 2017 by hospitalityInside.com and Union Investment places clear emphasis on B locations. And in the case of a crisis, of all segments it would be the midscale and first class hotels that come under pressure. The current sentiment in the hotel and investment sector remains good. However, expectations as revealed by the individual indices have shifted somewhat when compared to the previous year.

The EXPO REAL 2017 and its – anticipated – record visitor and exhibitor numbers at the beginning of October prompted hospitalityInside.com and Union Investment to launch the first survey after Europe's leading real estate and investment event. The well-attended trade fair offered plenty of opportunity for intense exchange.

Now that the supply of A locations in Germany has become thin on the ground, the question arises as to whether investors will in future focus more on B and C locations. The majority (52%) stated in the survey that they were convinced that B locations were already absorbing the spill over from premium locations. 34% of those surveyed indicated that A locations were packed with hotel chains right up to the rafters. Only 15% – and thus some way behind – saw a shift from B locations to C locations.

If there is a crisis, will this then result in a consolidation of hotel concepts and brands? 44% of those surveyed - that is, almost half - believed the adjustment will only take place in individual categories. 29% expect an effect in all categories. And who in particular could the crisis affect? The answer was clear: 62% expect impact on midscale and first-class hotels. 29% expect that the low budget and budget sector will come under strongest pressure in a crisis. On the other hand, they believed the luxury segment would be unaffected. Only 9% of those surveyed saw this category as at risk.

"The result confirmed the approach taken by our hotel fund UII Hotel No. 1, which is the first institutional vehicle to focus on investment in the budget hotel industry", Andreas Loecher says, Head of Investment Management Hospitality at Union Investment. "As regards midscale and first-class hotels, special requirements apply as regards the quality of location and property. In A locations, we feel very good in good and very good locations. In B locations, only top spots come into question".

|

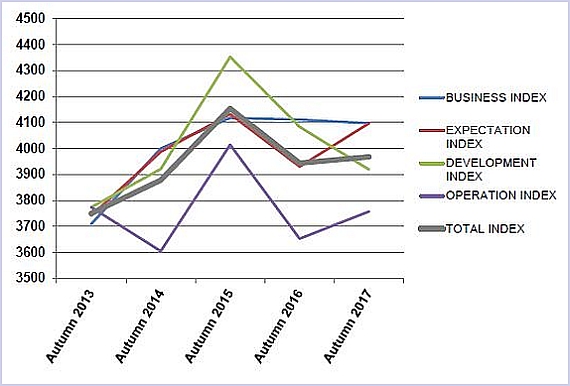

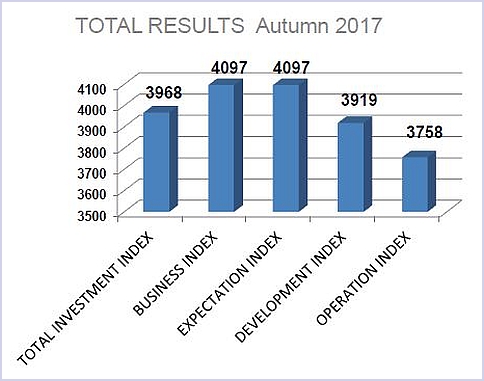

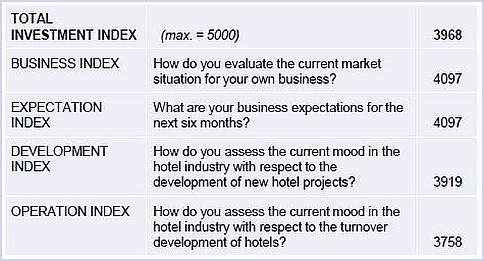

The overall index from the autumn survey 2017 revealed an increase of just 0.6% compared to 2016 and was thus steady. Managers’ assessments of the prospects of their own companies as well as their expectations of business performance remain at the same high level.

Extracts of the new results will also be published on the Union Investment website (www.union-investment.de/realestate) in the next days. hospitalityInside subscribers will find an extended version ("magazine version") of the current survey in the magazine. Participants of the survey already received the complete results.

Those who want to obtain the entire analysis of the survey in future must take part in the survey. Watch out for the announcement in the Friday newsletter of HospitalityInside. If you don't receive our newsletter, you can register here for the Investment Barometer. Registration and participation are free of charge.

In the attached PDF below, you will find all public information of the survey. / kn

INDEX:

|

|

|

|

| HospitalityInside_Investment_BAROMETER_Autumn_2017_Public_Version | |

|

|

|

|

|