2nd Investment BAROMETER confirms expectations in the young segments - Public Version

|

|

Augsburg/Hamburg (June 6, 2014). Currently, the rate-of-return considerations are driving the investments in hotels, more than diversification and security aspects. The overall mood in the hotel real estate market remained good in the first quarter of 2014. These are the central results of the latest "Investment BAROMETER", initiated by the hotel trade magazine hospitalityInside.com together with Union Investment.

For nearly 52 percent of the specialists surveyed in the hotel sector, the "rate of return" has been the most important investment aspect. Only 10 percent of the surveyed market participants stated "security" as their reason for investment. Another important investment reason is "diversification" at the moment; in fact, for 39 percent of the surveyed, this is the most important reason to invest right now.

"In the current environment of low interest rates, institutions for retirement planning as well as insurance companies are looking for respective levers for the rate of return. In addition, they are looking for opportunities to diversify their real estate portfolios further. Among the operator properties, hotel investments have become an equal option for many institutions alongside residential investment," says Andreas Loecher, Head of Investment Management Hotel of Union Investment Real Estate GmbH.

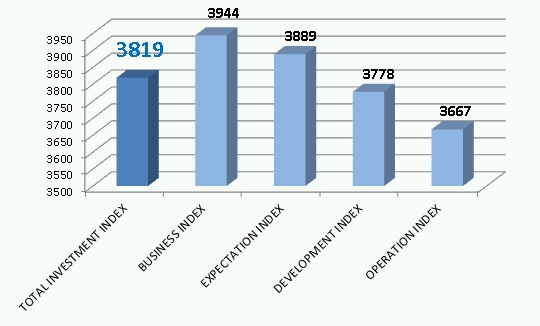

Compared to the previous quarter, the entire index of hospitalityInside's second "Investment BAROMETER" was able to increase slightly by 1.84 percent to 3,819 points. This further strengthens the basis for investments in the asset class of hotels.

Currently, budget hotels and serviced apartments seem to be connected to especially good perspectives concerning the rate of return. The prior survey certified that serviced apartments had the largest potential of developing into an investment product.

Those who want to obtain the entire analysis of the survey in future should register for the barometer and participate via this link. Registration and participation are free of charge. In today's issue, hospitalityInside subscribers will already find an extended version of the current survey.

The next survey will take place at the end of September up to the beginning of October 2014. During that time, the current survey links will be sent to all who have registered for the barometer.

In the attached PDF below, you will find all information about the publically accessible survey at a glance.

INDEX: TOTAL RESULTS Q1 2014

|

|

|

TOTAL INVESTMENT INDEX |

(max. = 5000) |

3 819 |

|

BUSINESS INDEX |

How do you evaluate the current market situation for your own business? |

3 944 |

|

EXPECTATION INDEX |

What are your business expectations for the next six months? |

3 889 |

|

DEVELOPMENT INDEX |

How do you assess the current mood in the hotel industry with respect to the development of new hotel projects? |

3 778 |

|

OPERATION INDEX |

How do you assess the current mood in the hotel industry with respect to the turnover development of hotels? |

3 667 |

In the first quarter of 2014, the mood in the hotel real estate market remained good, and the overall index was able to increase by 69 points to 3819 points (+1.84 percent) compared to the previous quarter. / map

| hospitalityInside Investment BAROMETER Q1 2014 Public Version | |

|

|

|

|

|