hospitalityInside Investment BAROMETER 2021: The asset class hotel approaches 2019 level again – Summary

|

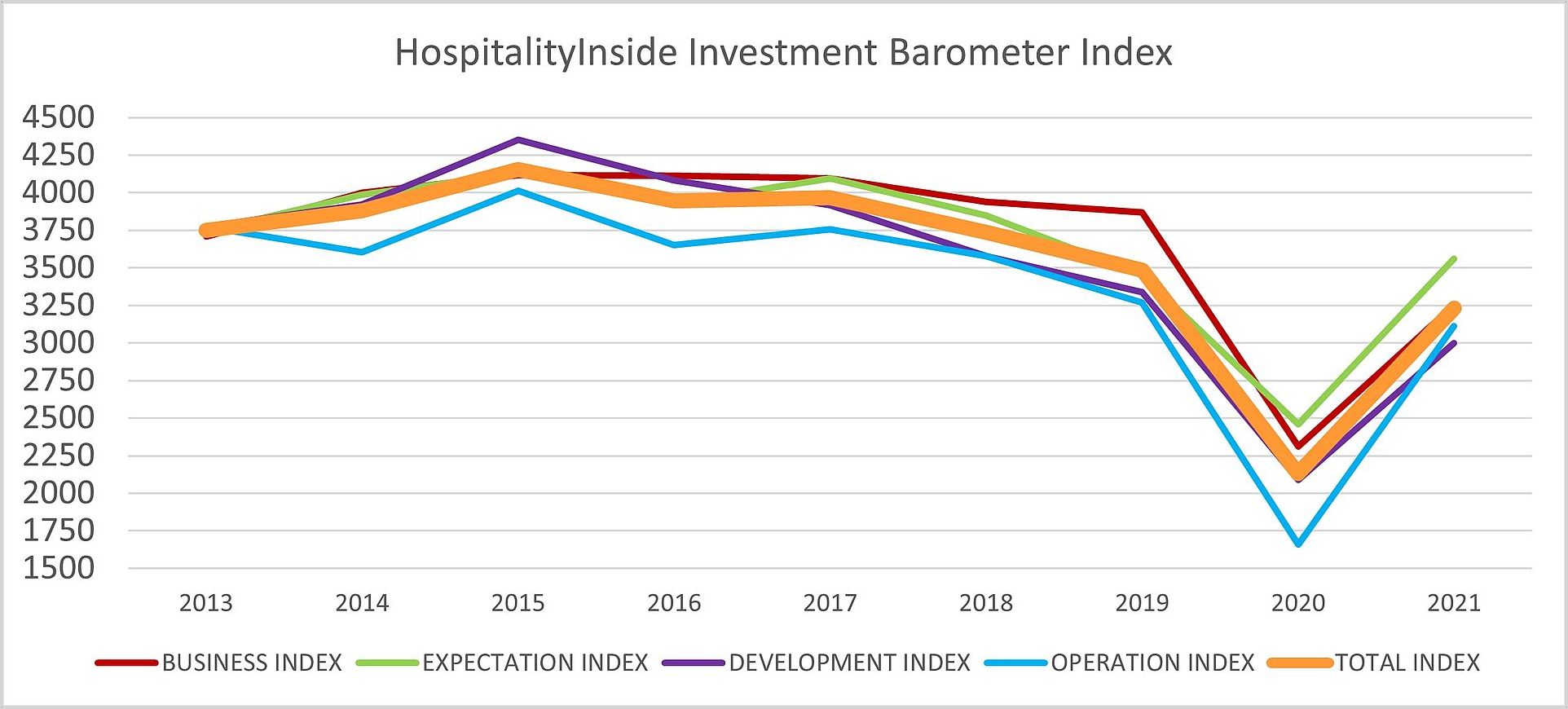

Augsburg (November 19, 2021). After the extremely massive slump last year, the index values of the current hospitalityInside Investment BAROMETER - surveyed in autumn by the specialist publisher HospitalityInside and Union Investment among around 60 hotel experts - are approaching those of 2019 again. On the trends: Currently, a lot of trust is flowing into leisure properties and in the future, more flexible contracts with variable leases will be in demand.

The increased values of the barometer in all four indices reflect the good summer business and the positive forecasts at the time of the survey. The dramatic increase in infection rates ("4th wave") with new editions only became apparent in the last week of the survey in November.

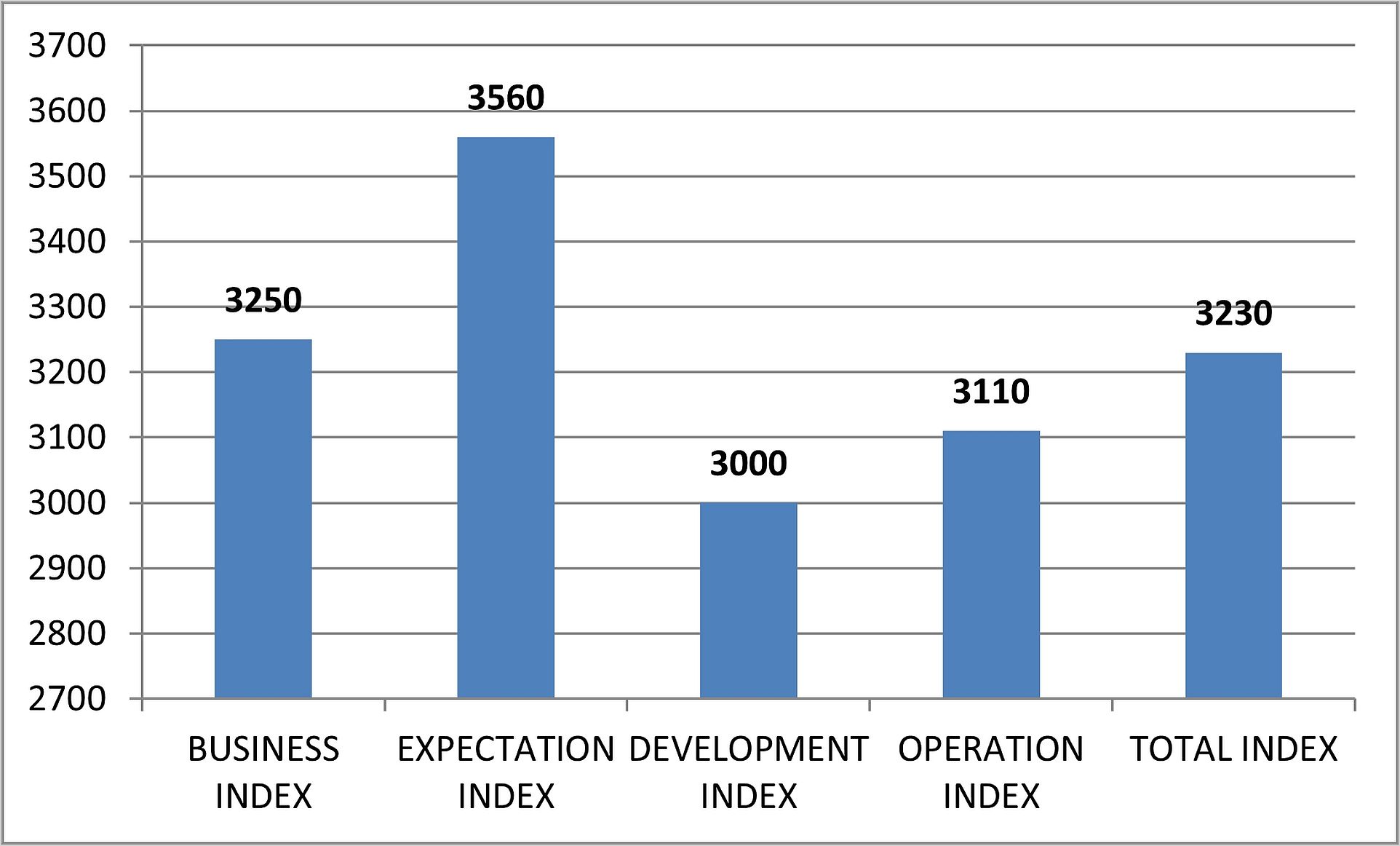

Looking at their own business, the Business Index rises by 41 percent to 3,250 points. And the expectations for the next half year reach the highest index value of this year's survey with plus 45 percent (from 2,460 to 3,560). The Development Index rises by 44 percent to 3,000 points (3,340 in 2019), reflecting the positive mood that was also evident at the Expo Real property fair. Turnover expectations also show a significant increase of around 88 percent to 3,110 points, which is not surprising given that travel restrictions, accommodation bans and cancellations dominated last year's survey.

Faster recovery expected in leisure segment

When it comes to the question of when yields in the different risk classes of hotels will return to their pre-crisis levels, core properties are ahead. Here, around 41 percent of the respondents expect yields to return as early as next year. For core-plus properties, a return of yields is expected by the majority in 2023, for value-add hotels even later.

Differentiated by Business and Leisure, the hotel experts expect a faster recovery in the leisure segment. Yields in this segment are expected to return to pre-crisis levels for core and core plus properties as early as 2022. This is what the majority of respondents believe, at 60 and around 45 percent respectively. Value-add business hotels will only manage this after 2023, say around 65 percent. In the leisure segment, things look better here as well: 65 percent of the respondents believe in a recovery already by 2023.

"The majority of respondents expect an earlier recovery of the holiday hotels than the business hotels. This also corresponds to our assessment. Hotels, especially on the German North Sea and Baltic Sea, have achieved record results in terms of RevPAR this year," says Andreas Löcher, Head of Investment Management Hospitality at Union Investment. "In our opinion, the scarcity of the resource staff as well as sharply rising operating costs represent the biggest challenges in the short to medium term that hoteliers now have to face."

Variable lease elements on the way to becoming the new standard

When asked about the contract forms that will be seen most in the hotel sector in the medium term, 76 percent give the assessment that there will generally be pandemic add-ons in contracts in the future. That the fixed lease will remain a dominant contract form in the German market in the medium term is the opinion of 34 percent. Variable lease elements will obviously become the new standard, with 14 percent of respondents expecting variable shares of over 30 percent, and 26 percent of respondents of under 10 percent. A majority of 52 percent expect a corridor of 10 to 30 percent here.

"This is a new development, as in our experience lower variable rents or pure fixed rents have been agreed upon so far," says Andreas Löcher. "What the survey confirms: The management contract will not be a dominant contract form in the future either. Not even after Corona." Less than a third (28 percent) of the respondents believe that management contracts will be seen most strongly in the market in the medium term.

The bottom line in autumn 2021 is that the hotel sector, which was one of the hardest hit by Covid-19, is back in the market. Bookings in the leisure sector are reaching peak values in some cases, and the first positive developments can be seen in conferences. The guests are coming back. The will and the ability to adapt are there. Now only the international guests are missing. The positive development could be disturbed by new, possibly drastic contact restrictions.

|

> Subscribers will find the complete results in the magazine.

> Extracts of the latest results are also published on the Union Investment website

(www.union-investment.de/realestate).

|

|

|

Next survey: Autumn 2022 |

Would you like to participate in the future?

If you want to participate in the next survey, register on hospitalityInside.com for the free newsletter. This way you will be informed every week about the latest topics and receive information about trade fair activities, events, the HITT Think Tank and of course the surveys. If you want to receive the complete evaluation, you can subscribe to the magazine or take part in the survey next time and simply enter your e-mail address after the last question. Anonymity is preserved. / kn