hospitalityInside INVESTMENT BAROMETER Autumn 2020 shows what counts: Diversified portfolio, Contracts with Upside/Downside, Credit rating - Public Version

|

| Dull autumn days for the hotel industry. / Photo: unsplash hannah domsic |

Augsburg/Hamburg (November 13, 2020). Despite the corona pandemic, there is still a lot of liquidity in the German hotel real estate market. Accordingly, the interest in the asset class hotel basically remains strong. Individual priorities have changed: A well-diversified hotel portfolio is the primary condition for a continued commitment in the hotel industry, as are more flexible contracts. This and more is revealed by the current hospitalityInside INVESTMENT BAROMETER 2020, which the specialist publisher carries out every autumn together with Union Investment.

The 2020 survey was launched on 9 October and ended on 6 November. The period saw the (re)introduction of accommodation bans, cancellations of trade fairs, waves of cancellations, growing numbers of infections and, of course, the second lockdown. The good news that an effective vaccine had been found only came afterwards.

The fine reaction of the market to the uncertainty caused by corona since March and to the discussions in the industry are shown by the answers to the two trend questions, which were: What are the most important arguments in favour of the asset class 'hotel'? And: The pipelines are shrinking! Which scenarios are likely?

Through the course of the crisis, which has placed the hotel sector before enormous challenges, the requirements and the arguments in favour of a future investment in this asset class have become clearer than ever before. For 64 percent of those surveyed, "good diversification within the hotel portfolio" is one of the most important prerequisites for a (re)commitment to the hotel markets. "More flexible contracts taking into account upside/downside scenarios" is a condition imposed by 60 percent of those surveyed.

For 46.5 percent, "operators with a good credit rating" are the prerequisite for a foreseeable return on a hotel investment. The importance of "new contract clauses in the event of a pandemic" is given similar weight (43.8 percent).

Hotel groups are still reporting new openings or the start of new projects that were signed before corona. Meanwhile though, the pipelines are visibly shrinking. "The almost complete standstill in terms of transactions indicates that there is still a wide spread between supply and demand prices. At the same time, corona is artificially holding back guest demand for hotels, which is in itself delaying the market recovery," says Andreas Löcher, Head of Investment Management Hospitality at Union Investment.

"Only moderate price reductions"

What scenarios does this create? In the hotel investment BAROMETER 2020, the following picture emerges: Well over half of those surveyed (around 59 percent) believe it is likely that owner-operator and direct leases will gain in significance in future. A similarly large group believes that the market will in future be dominated by cash-rich companies: 53.4 percent of those surveyed believe that only these players are still capable of investing.

Although only a minority (16.4 percent) expects the hotel asset class to emerge from the crisis ahead of other asset classes, especially retail, there is still optimism. Nevertheless, the expectation of around 52 percent of those surveyed that hotel yields will come under pressure again after the pandemic and its aftermath due to recurring demand and the associated recovery of the hotel markets, contains some optimism that the asset class will attract strong investor interest again in the future. Just 20.5 percent of those surveyed assume that more money will be invested in A and B locations and less money will flow into C and D locations.

"We assume that there is still a lot of liquidity in the market looking for investment opportunities, especially in the lower hotel segments and the aparthotel sector. At least in the short term then only moderate price discounts can be expected in Germany," says Andreas Löcher.

Index clearly reflects collapse in sentiment

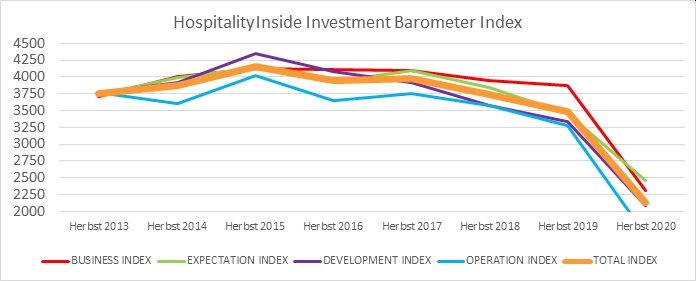

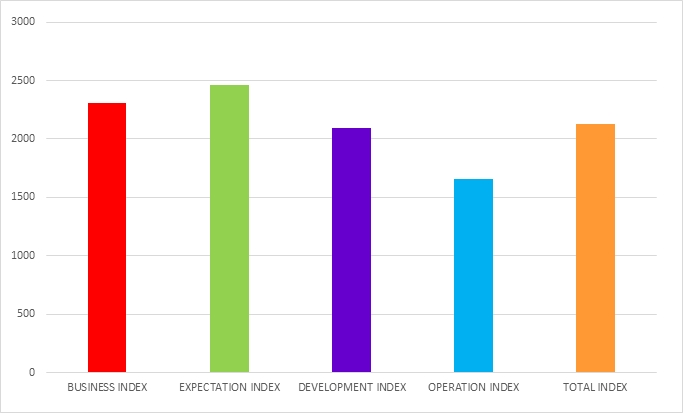

The INVESTMENT BAROMETER Index 2020 shows a significant drop compared to the previous year, falling from 3,483 to 2,130 points.

|

In detail: The Business Index provides an overview of current business. It slumped by 40.31 percent compared to the previous year, but a look at the next six months reveals hopes of a slight improvement, with the Expectation Index declining by "only" 28.7 percent.

Expectations for the hotel industry show a much worse picture: The Development Index falls by 37.43 percent from 3,340 to 2,090 percent, the Operation Index by 49.24 percent (from 3,270 in 2019) to 1,660 percent in 2020.

That the Business Index reveals a better picture than expectations in general for the hotel industry is likely due to the lower number of participating hoteliers in the current survey. This time they represented only 37.5 percent of respondents, in contrast to 50 percent in the 2019 survey. At 43 percent, consultants made up the largest group among the participants (2019: 28 percent). / kn

|

|

The indices of the HospitalityInside Investment Barometer Autumn 2020. / Graphics: HI |

> Subscribers will find the complete results in the magazine.

> Extracts of the latest results are also published on the Union Investment website

(www.union-investment.de/realestate).

Would you like to participate in the future?

If you want to participate in the next survey, register on hospitalityInside.com for the free newsletter. This way you will be informed every week about the latest topics and receive information about e.g. trade fair activities, events, the HITT Think Tank and of course the surveys. If you want to receive the complete evaluation, you can subscribe to a magazine access or take part in the survey next time and simply enter your e-mail address after the last question. Anonymity is preserved. / kn